- Originally Published on December 29, 2022

What is an Evergreen Retainer Agreement?

It can be an overwhelming and confusing task to find an attorney—in no small part because of the different payment structures available. If you spend any time consulting with attorneys for your online defamation or internet harassment matter, you may run across the term ‘evergreen retainer’.

An evergreen retainer is a type of payment agreement where the client pays a deposit in advance of legal services and is placed into a separate trust account. This advance payment is not billed against by the attorney and/or law firm during the course of representation. Instead, evergreen retainer fee clients typically pay for services by monthly invoice, and the evergreen retainer is saved to cover outstanding balances (if any) at the end of representation.

At Minc Law, we prioritize trust and transparency—especially when it comes to financial matters. You do not take your financial decisions lightly, which is why we make it our mission to empower you to better understand potential costs, how billing works at our firm, and the terminology used in common legal retainers.

In this article, we define an evergreen retainer and how it is different from a standard retainer fee. We then explain the benefits, drawbacks, and key components of an evergreen retainer fee agreement. Finally, we provide a real-life example of the agreement we use at Minc Law.

With a team of experienced attorneys, we will fight for the closure you deserve. Take back control today.Don't suffer in silence.

What is an Evergreen Retainer Fee Agreement?

In an evergreen retainer, clients pay a fee in advance into a separate trust account. At Minc Law, we bill against this evergreen retainer each month as legal services are rendered on a client’s matter, while also requiring payment in the same amount to replenish the retainer if further work is needed on a client’s legal matter. In this way, the retainer stays at the same amount until the case is over—in other words, the retainer is evergreen.

How Does an Evergreen Retainer Fee Work?

Many lawyers and other service professionals use an evergreen retainer, which is an advance payment that is maintained at a specific minimum balance. The attorney or expert then bills separately for any charges incurred as they work on the case.

The idea for an evergreen retainer is to ensure the case costs are always paid ahead of time. This process benefits both the client and the attorney (or another service provider) because it acts as a safety net of sorts—since the retainer is never depleted.

How is an Evergreen Retainer Different From a Standard Retainer Fee?

In a standard retainer fee structure, a client pays a lump sum ahead of time (say, $8,500). The attorney then bills against that amount as they work on the case. Once that retainer has been depleted (used entirely), the client is billed for any additional work at the attorney’s hourly rate.

In an evergreen retainer, on the other hand, the advance payment is replenished monthly and is never depleted. The evergreen retainer is placed into an IOLTA (Interest on Lawyers’ Trust Account).

The attorney sends a separate, monthly invoice to the client to cover any costs incurred for the month. The evergreen retainer is used to cover outstanding balances so that there is no delay in the payment of invoices. Whenever the evergreen retainer dips below a minimum balance, the client is then asked to replenish the amount.

At the end of the matter, as long as there are no outstanding balances, the client then receives their retainer back.

Common Uses of an Evergreen Retainer Fee

A wide variety of professionals use evergreen retainer fees. Evergreen retainers are the most popular among service-based professionals like attorneys, accountants, consultants, and freelancers. These professionals all typically work for multiple clients simultaneously, with large or complex projects that may take several weeks or months to complete.

Even within a specific industry, a professional may not use an evergreen retainer for every client. Attorneys, for example, often only use evergreen retainers for litigation matters such as:

- Personal injury,

- Criminal and civil cases,

- Divorce and family law,

- Probate, and

- Medical malpractice.

These types of cases can go on for several weeks or even months, and a retainer can help professionals generate a steady cash flow as they apply hours toward each matter. This fee structure allows attorneys to set aside an allotment of time to work on a case and know that they have a reliable fund to bill their time against.

What Should Be Included in an Evergreen Retainer Agreement?

Every legal situation is unique, and no two retainer fees are identical. While each retainer agreement is tailored to the specific case, most do contain a few of the same core components.

What Key Components Must Be Included in an Evergreen Retainer Agreement?

If you decide to retain an attorney, you will most likely be asked to sign a retainer fee agreement. Regardless of the fee structure, all retainer fee agreements should include the following elements:

- A description of the scope of work the professional will undertake,

- An explanation of the legal fees and invoicing process,

- Information on how the client will be billed and how often to expect an invoice,

- Details of what happens when the retainer and/or legal fees are depleted,

- The minimum balance to be kept in the client’s trust account,

- When and how the client will replenish funds, and

- How additional expenses will be handled.

In an evergreen retainer agreement, the minimum retainer balance may be the same across all of the professional’s cases. Or you and your attorney may choose an amount based on your specific case and budget.

The agreement may also state that the work will stop if the client does not honor the evergreen retainer clause.

What Optional Components May Be Included in an Evergreen Retainer?

Beyond the core components listed above, an evergreen retainer agreement should delve into specific details relating to the case and how it will be handled. You and your attorney may decide to customize the retainer agreement by including clauses like the ones listed below to define your attorney-client relationship.

Insurance

If part or all of your legal fees are being paid for by an insurance company, an insurance clause should explain how these fees will be paid. The clause should also stipulate what happens if the insurance company fails to cover all of the costs of the case.

Guaranteed vs. Not Guaranteed Service

If your attorney offers guaranteed service, they will refund your retainer if the service is not completed (or the case is not successful). But if your agreement is for a non-guaranteed service, the attorney keeps your fee regardless of the outcome of the case.

In either situation, you and your attorney may include a clause in your retainer agreement clarifying whether the services are guaranteed or not.

Arbitration & Mediation

These types of clauses can give guidance on how to handle a dispute. In mediation, the disputing parties determine how to resolve the problem, but a neutral third party facilitates the discussion. In arbitration, a private judge or third party hears both sides and decides how to solve the dispute.

Interest Accrual Rates

If your attorney charges interest on late fees, this clause will specify how the interest is charged. For example, they may charge 10% simple interest starting 60 days after the invoice is issued.

How to Customize an Evergreen Retainer to Fit Your Legal Issue

Before finalizing a retainer fee agreement, you should ensure that it fits your needs and goals. Keep in mind that lawsuits usually have a longer time frame and take more labor hours to complete. Therefore, these litigation matters tend to be more expensive—which is why they often require a higher upfront retainer.

In contrast, solving a case without litigation (in other words, outside of the courtroom) is usually a much simpler matter. Many non-litigation cases only require one or two attorneys and take much less effort and time to resolve. The retainers for these types of cases are usually smaller in proportion.

We recommend making sure you and your attorney are on the same page about the following issues:

- The estimated timeline for resolving the matter,

- Your budget and any concerns about price,

- Which outcomes or settlements you will accept, and

- Who (if anyone) the attorney can speak to about your case.

Benefits of Having an Evergreen Retainer Fee Agreement

An evergreen retainer can provide benefits to both the client and the attorney. In this section, we list the advantages of such a fee structure—along with a few instances in which an evergreen retainer might not be the right fit.

What Are the Benefits For a Client When Using an Evergreen Retainer?

In some ways, an evergreen retainer resembles a security deposit. The client pays a predetermined amount that will be returned to them if nothing unexpected happens. But if there is an issue—such as a bounced check or a late payment—the retainer acts like a security cushion. It also provides guidance as to what an expected maximum budget is for any given single invoice.

A clearly-defined evergreen retainer can help avoid miscommunication and frustration. Without a retainer, a client may not know the final cost of the matter until its conclusion. Receiving the total cost at the end of a matter can be overwhelming, not to mention surprisingly high. Breaking up the costs regularly can be more practical and avoid surprises or conflicts at the end of the case.

If the client becomes dissatisfied with the attorney’s services, they can easily end the attorney-client relationship by not refilling the retainer.

Conversely, a retainer fee can facilitate an ongoing attorney-client relationship. If another legal issue arises that needs to be managed quickly, a retainer can fund it on short notice. Having an attorney on retainer can give you peace of mind knowing you have legal representatives that are already familiar with you and your business.

Can an Evergreen Retainer Be Refunded?

If the money in a retainer is not used during the matter, it can usually be refunded. For instance, say your attorney estimated that the case would cost $8,500, but the matter was resolved after only $5,000 was used. In that case, the remaining $2,500 would be refunded back to you.

For litigation clients who sign an engagement agreement with an evergreen retainer at Minc Law, we aim to return unused funds as soon as possible—either by mailing a check or through card payment. If the client wants to keep the matter open, we also give them the option to transfer the funds into a standard retainer.

How Long is an Evergreen Retainer Good For?

If the terms in the original agreement have not changed, an evergreen retainer will “stay good” for as long as the client wishes to keep it valid.

The retainer can remain open-ended until the client requests to close out the case.

How Do Evergreen Retainers Benefit Attorneys & Law Firms?

Evergreen retainers are not only beneficial for clients; they can also benefit attorneys. A retainer fee supplies a regular cash flow that lets attorneys work on a matter without worrying about running out of funds or needing to bill a client for every cost that arises during litigation.

Also, because they do not rely on a succession of isolated contracts, a retainer fee structure allows attorneys to focus on their current clients’ cases instead of constantly looking for new clients.

Are There Limitations to an Evergreen Retainer Fee?

One of the primary limitations of an evergreen retainer is that they are not suited for simple, short-term work. They are based on a predicted amount of time, work, and costs associated with a complex matter.

And because various elements can influence a case’s outcome, most attorneys cannot guarantee success. But regardless of the results of the case, an attorney must still bill for their time and expertise. With a retainer fee agreement, you will pay the costs of the matter but may not obtain your desired results.

Example of an Evergreen Retainer Agreement

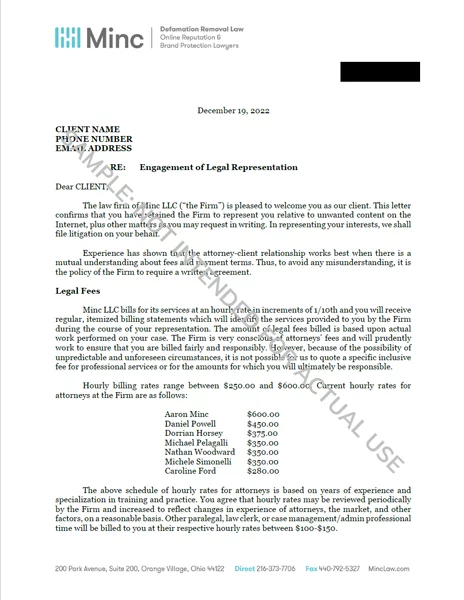

Understanding an evergreen retainer in theory is helpful, but seeing a real-life example is even more beneficial. Below, we have provided a detailed illustration of a retainer agreement we use at Minc Law.

Minc Law Evergreen Retainer Fee Agreement Example

(Click to download PDF)

★★★★★

“I thank/recommend MincLaw/Ms.Carolyn Ford JD with the highest regards for the assistance that they provided in helping me with 2 horrific false reviews on yelp.Yelp had constructed a business page for “my benefit”.When I checked the page I saw a vicious 1 star false review from a person for whom I have no medical record/billing record. The review was horrific.My attempts to contact this pt thru the yelp website was fruitless. My lawyer had no expertise in internet defamation.I found Minclaw which specializes in internet defamation.I was assigned Ms C Ford JD. who did an OUTSTANDING job with the above review.I also had an another nasty review from a yelp reviewer with 156 mostly 1 star reviews with hostile false statements. Ms. Ford contacted this person and after intense back and forth with this reviewer, she deleted her review. Yelp is a NIGHTMARE. Your only course of action is to deal directly with the reviewer for which you need a law firm that specializes in internet defamation.”

RNC MD

Nov 15, 2022

If you have any questions about your evergreen retainer fee, or if we are the right fit to help you tackle your online defamation or internet privacy issue, please reach out by calling us at (216) 373-7706, speaking with a Chat representative, or filling out our online contact form.

Get Your Free Case Review

Fill out the form below, and our team will review your information to discuss the best options for your situation.

This page has been peer-reviewed, fact-checked, and edited by qualified attorneys to ensure substantive accuracy and coverage.